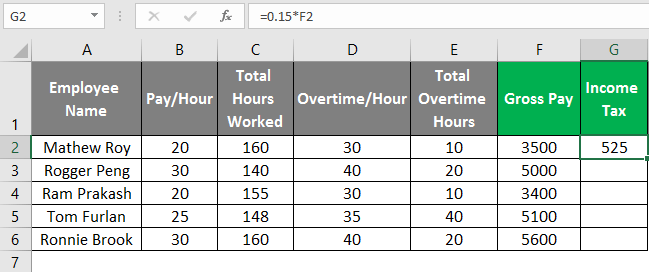

Dec 7, 2023December 07, 2023 What is Net Pay? Net pay is the amount of pay remaining for issuance to an employee after deductions have been taken from the individual’s gross pay. This is the amount paid to each employee on payday. Thus, the net pay calculation is: Gross pay – Payroll taxes – Other deductions = Net pay

How to Prepare an Income Statement | HBS Online

Jan 18, 2024Formula: Net pay = Gross pay – Total payroll deductions To calculate net pay, you’ll need to know your gross pay, as well as the specific deductions that apply to your situation. If

Source Image: washburn.edu

Download Image

*To Deposit 100% of your Net Pay in one bank account you must use Balance as the Deposit Type . Click: “Submit” … that is deposited first and so on in the order of priority with any remaining going into the Balance account. Direct Deposit Examples: … You may delete any account except the ‘balance account’.

Source Image: educba.com

Download Image

Direct Deposit Examples”,Microsoft Word – Examples.docx

The Demise of the Paper Check as a Useful Method of Paying Workers. If the recent and continuing global health event has demonstrated one thing – it is that compensating people via paper checks is unreliable, unsafe and untenable. And as the leading provider of payroll in the United States (we pay roughly 1 in 6 Americans), ADP fully

Source Image: venngage.com

Download Image

Any Remaining Net Pay May Be Issued By Paper Check

The Demise of the Paper Check as a Useful Method of Paying Workers. If the recent and continuing global health event has demonstrated one thing – it is that compensating people via paper checks is unreliable, unsafe and untenable. And as the leading provider of payroll in the United States (we pay roughly 1 in 6 Americans), ADP fully

Jan 23, 2023Suppose an employee wants to kno w what is the net amount of pay on their salary of $4,000 per month. If deductions for all taxes and benefits total $800, $3,200 would be their remaining net pay, meaning that’s the amount they take home to spend. Of course, employees might not necessarily use the term “net pay” in their discussions with you.

20+ White Paper Examples, Templates + Design Tips – Venngage

Balance of Net Pay: Use this option if you want the remaining net pay amount (after all other deposit types have been distributed) deposited to the bank account. Percent: Use this option if you want to specify a percentage of pay to be deposited to the bank account. For this example, click the Balance of Net Pay list item.

What is Content Distribution and How it Works? | Outbrain blog

Source Image: outbrain.com

Download Image

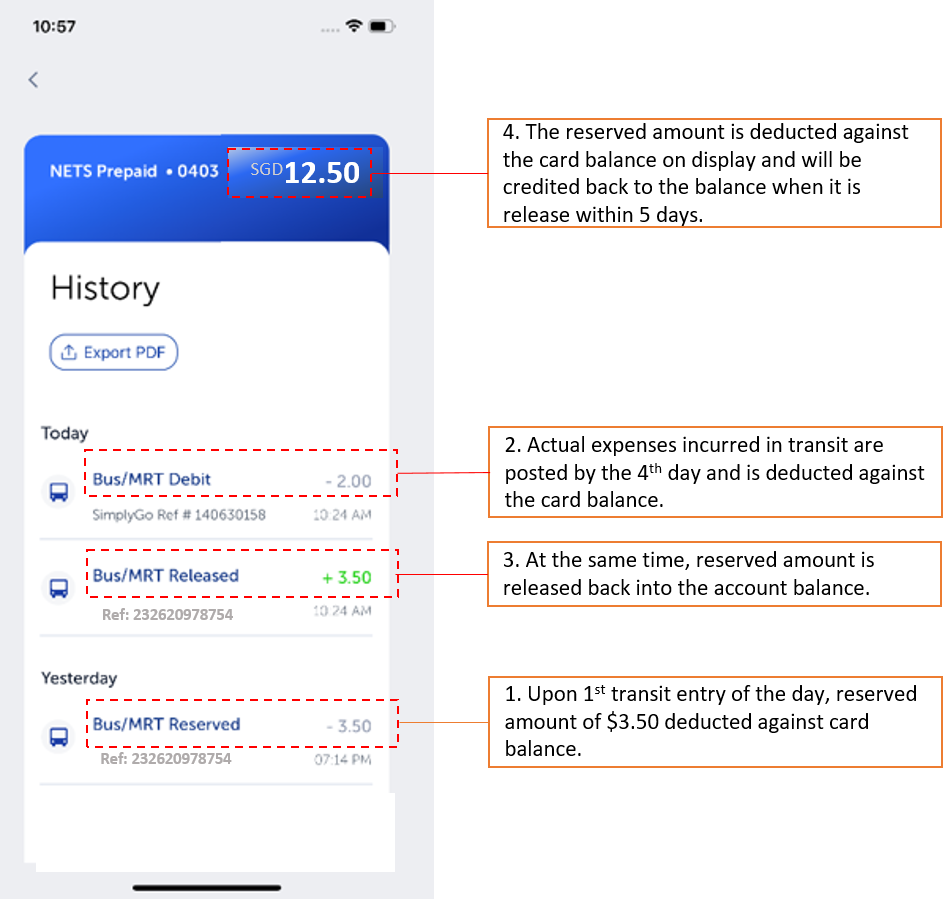

NETS for you Support – NETS

Balance of Net Pay: Use this option if you want the remaining net pay amount (after all other deposit types have been distributed) deposited to the bank account. Percent: Use this option if you want to specify a percentage of pay to be deposited to the bank account. For this example, click the Balance of Net Pay list item.

Source Image: nets.com.sg

Download Image

How to Prepare an Income Statement | HBS Online

Dec 7, 2023December 07, 2023 What is Net Pay? Net pay is the amount of pay remaining for issuance to an employee after deductions have been taken from the individual’s gross pay. This is the amount paid to each employee on payday. Thus, the net pay calculation is: Gross pay – Payroll taxes – Other deductions = Net pay

Source Image: online.hbs.edu

Download Image

Direct Deposit Examples”,Microsoft Word – Examples.docx

*To Deposit 100% of your Net Pay in one bank account you must use Balance as the Deposit Type . Click: “Submit” … that is deposited first and so on in the order of priority with any remaining going into the Balance account. Direct Deposit Examples: … You may delete any account except the ‘balance account’.

Source Image: bgsu.edu

Download Image

The 11 best online form builder apps | Zapier

How to calculate net pay. Net pay = gross pay – taxes withheld – deductions withheld. Now that you have a grasp on gross pay, let’s talk taxes and deductions you might withhold from an employee’s check. Taxes withheld include state and federal income taxes, as well as Social Security and Medicare. You’ll need to have all employees

Source Image: zapier.com

Download Image

How technology can support responsible research and drive a culture of research integrity

The Demise of the Paper Check as a Useful Method of Paying Workers. If the recent and continuing global health event has demonstrated one thing – it is that compensating people via paper checks is unreliable, unsafe and untenable. And as the leading provider of payroll in the United States (we pay roughly 1 in 6 Americans), ADP fully

Source Image: turnitin.com

Download Image

25+ Impactful Consulting Report Templates to Present Findings

Jan 23, 2023Suppose an employee wants to kno w what is the net amount of pay on their salary of $4,000 per month. If deductions for all taxes and benefits total $800, $3,200 would be their remaining net pay, meaning that’s the amount they take home to spend. Of course, employees might not necessarily use the term “net pay” in their discussions with you.

Source Image: venngage.com

Download Image

NETS for you Support – NETS

25+ Impactful Consulting Report Templates to Present Findings

Jan 18, 2024Formula: Net pay = Gross pay – Total payroll deductions To calculate net pay, you’ll need to know your gross pay, as well as the specific deductions that apply to your situation. If

Direct Deposit Examples”,Microsoft Word – Examples.docx How technology can support responsible research and drive a culture of research integrity

How to calculate net pay. Net pay = gross pay – taxes withheld – deductions withheld. Now that you have a grasp on gross pay, let’s talk taxes and deductions you might withhold from an employee’s check. Taxes withheld include state and federal income taxes, as well as Social Security and Medicare. You’ll need to have all employees