Debt Collection: A Growing Concern

Image: localnewsmatters.org

The burden of debt has become an increasingly pressing issue in the United States, with millions of Americans struggling to make ends meet. One of the most distressing aspects of this situation is the potential for debt lawsuits, which can have severe consequences for individuals and families. If you find yourself facing a debt lawsuit in Texas, it is crucial to understand your rights and explore the options available to you. This comprehensive guide will provide valuable insights into the strategies and procedures for getting a debt lawsuit dismissed in Texas, empowering you to navigate this challenging legal landscape.

Grounds for Dismissal

There are several grounds upon which you may seek to have a debt lawsuit dismissed in Texas. The most common of these include:

1. Lack of Proper Service

The plaintiff (creditor) must properly serve you with the lawsuit and supporting documents within an allotted time frame. If they fail to do so, you may have grounds for dismissal.

2. Errors in the Complaint

The creditor’s complaint must clearly state the nature of the debt and the amount owed. Any material errors or missing information may lead to dismissal.

Image: www.pdffiller.com

3. Statute of Limitations

Each type of debt carries a specific statute of limitations, which is the time period within which a creditor can sue you. If the lawsuit is filed after the statute of limitations has expired, it may be dismissed.

4. Failure to Prove Debt

The creditor has the burden of proving that you owe the debt. If they fail to provide sufficient evidence, the lawsuit may be dismissed.

Steps to Get a Lawsuit Dismissed

If you believe that you have grounds for dismissal, you must promptly take the following steps:

1. File an Answer

You have 20 days from the date of service to file an answer to the lawsuit. In your answer, you will outline your reasons for seeking dismissal.

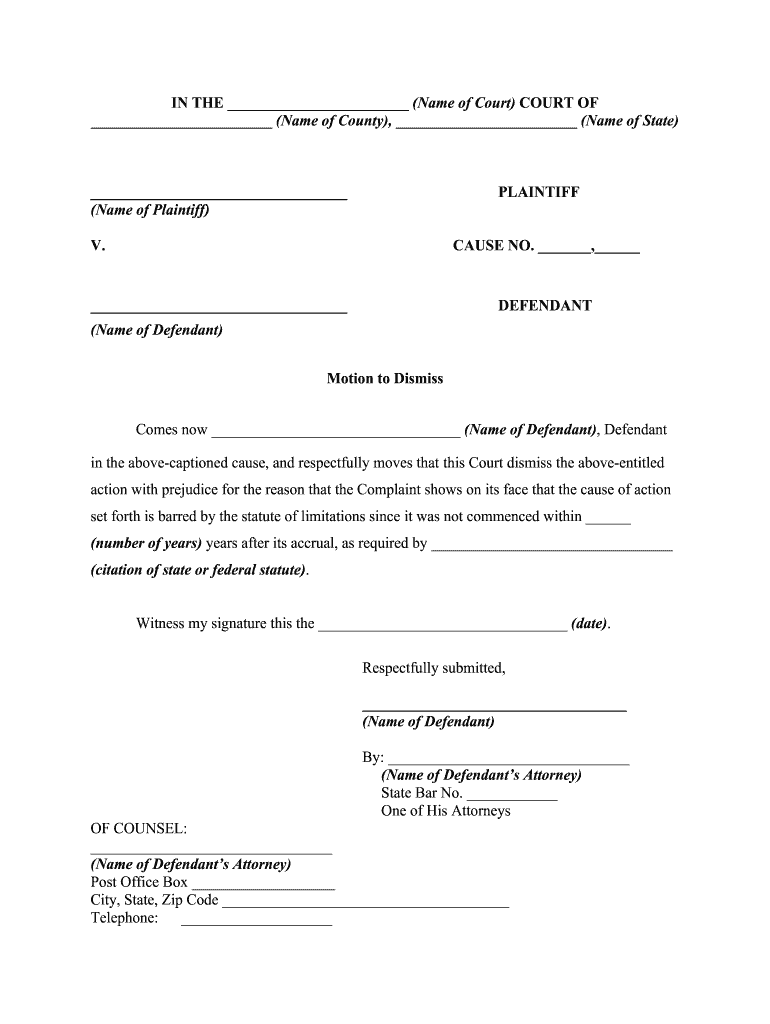

2. File a Motion to Dismiss

Along with your answer, you should file a formal motion to dismiss the lawsuit. This motion will provide detailed legal arguments supporting your request.

3. Attend a Hearing

The court may schedule a hearing to consider your motion. Be prepared to present evidence and argue your case in front of a judge.

Additional Strategies

In addition to the grounds for dismissal mentioned above, there are other strategies that you may consider:

1. Negotiating with the Creditor

Contacting the creditor to discuss a payment plan or settlement may help you avoid a lawsuit or have the lawsuit dismissed.

2. Seeking Credit Counseling

Credit counseling agencies can provide guidance and support in managing your debt and potentially reduce the likelihood of legal action.

3. Filing for Bankruptcy

In certain circumstances, filing for bankruptcy may discharge your debts and protect you from lawsuits. However, it is crucial to consult with an experienced bankruptcy attorney before making this decision.

How To Get A Debt Lawsuit Dismissed In Texas

Conclusion

Facing a debt lawsuit can be an overwhelming experience, but it is important to remember that you have rights. By understanding the grounds for dismissal and following the proper procedures, you can increase your chances of getting a debt lawsuit dismissed in Texas. Remember to promptly consult with an attorney if you need legal guidance or representation.