Introduction

Image: www.4allcontracts.com

The world of healthcare revolves around insurance, a vital component that ensures patients have access to necessary medical services. As a healthcare professional or business owner, securing contracts with insurance companies is paramount to the financial stability and growth of your practice. However, navigating the complex insurance landscape can be challenging. This article provides a comprehensive guide to help you successfully obtain contracts with insurance companies, empowering you to expand your reach and improve patient care.

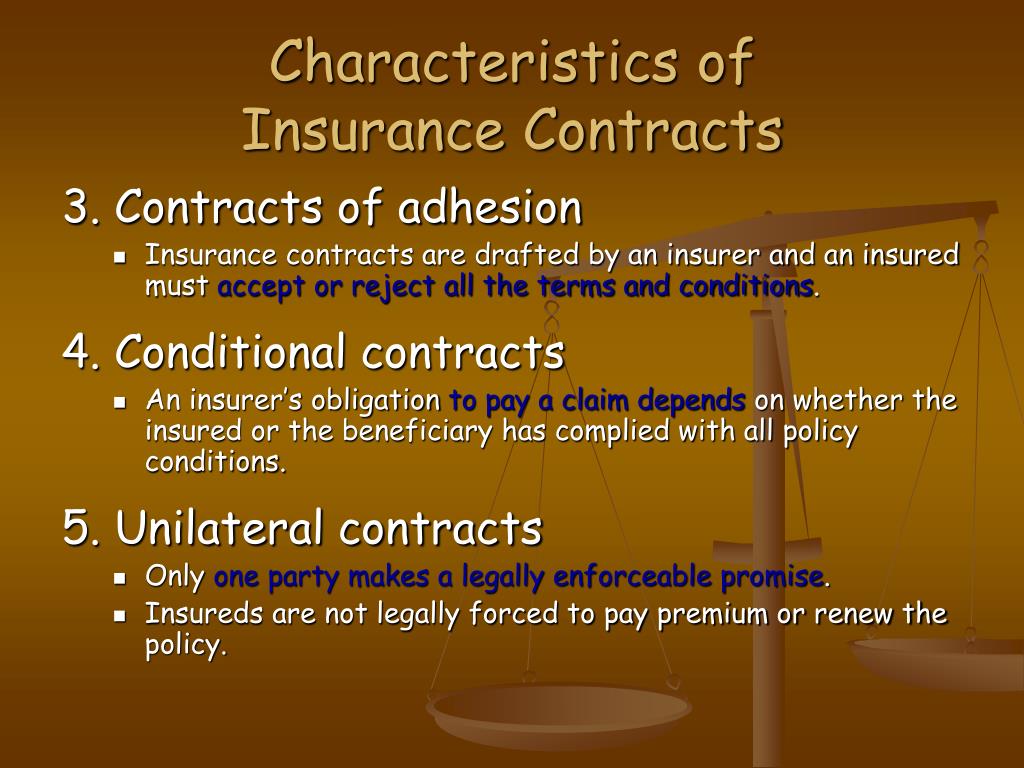

Understanding Insurance Contracts

An insurance contract, also known as a policy, is a legally binding agreement between an insurance company and an insured party (e.g., a healthcare provider or patient). It outlines the terms and conditions of coverage, including the types of services covered, exclusions, deductibles, and reimbursement rates. Understanding the key elements of an insurance contract is essential for successful contract negotiations.

Types of Insurance Contracts

Various types of insurance contracts exist in healthcare, each designed to cover specific needs. Common types include:

- Professional Liability Insurance: Covers healthcare professionals against claims of negligence or malpractice.

- Commercial General Liability Insurance: Provides coverage for businesses against lawsuits related to bodily injury or property damage.

- Workers’ Compensation Insurance: Protects employers from claims by employees who suffer workplace injuries or illnesses.

- Group Health Insurance: Insures a group of individuals (e.g., employees or members of an organization) against medical expenses.

Steps to Securing Contracts

Obtaining contracts with insurance companies involves several crucial steps:

-

Research and Profile Insurance Companies: Identify insurance companies operating in your region and research their financial stability, reputation, and market share. Build a profile of each company to understand their target market, coverage options, and contractual requirements.

-

Network and Attend Industry Events: Establish professional contacts within the insurance industry by attending conferences, trade shows, and networking events. Connect with insurance company representatives and learn about their business needs and contracting practices.

-

Prepare a Comprehensive Proposal: Develop a well-crafted proposal that showcases your practice’s strengths, experience, and value proposition. Include information on your services, provider qualifications, financial stability, and risk management measures.

-

Negotiate Contract Terms: Once your proposal is accepted, negotiations begin. Carefully review and discuss all contract terms, including coverage details, reimbursement rates, billing procedures, and dispute resolution mechanisms. Seek legal advice if necessary to ensure your interests are protected.

-

Maintain Effective Communication: Establish clear and proactive communication channels with insurance company representatives. Respond to inquiries promptly, submit claims accurately and efficiently, and maintain documentation to support your claims.

Tips for Successful Contract Management

Once you secure contracts with insurance companies, it is essential to manage them effectively:

- Stay Informed: Keep abreast of changes in insurance regulations and market trends to ensure compliance and adapt to industry developments.

- Maximize Reimbursement: Understand reimbursement codes and billing guidelines to optimize claim submissions and maximize reimbursement rates.

- Resolve Disputes Amicably: Establish protocols for resolving disputes quickly and amicably to maintain positive relationships with insurance companies.

- Maintain Credentialing: Ensure that your practice and providers maintain proper credentialing to meet insurance company requirements for reimbursements.

Conclusion

Securing contracts with insurance companies is vital for the success and sustainability of healthcare practices. By understanding insurance contracts, networking within the industry, preparing a comprehensive proposal, negotiating effectively, and managing contracts strategically, you can establish mutually beneficial partnerships with insurance companies. This will enable you to expand your reach, improve patient care, and contribute to the overall health and well-being of your community.

Image: www.slideserve.com

How To Get Contracts With Insurance Companies

https://youtube.com/watch?v=QcU-BUEyidQ