Jan 18, 2024The main difference between the 402b and other retirement plans is that if you have 15 years of service and your company is considered a “qualified organization”, you may be eligible to contribute an extra $3,000 to a 403(b). Therefore, 403b max contribution potentially increases to $22,500 or $29,000 per annum if you’re 50 or older.. Another difference is that 403(b) plans can only offer

How Much Money Do I Really Need to Retire? – Quick and Dirty Tips

Jan 12, 2024For 2024, the total contribution limit for a 403 (b) is $23,000. But if you’re age 50 or older and need to catch up, you can put up to $30,500 into your account. 1. And folks with a 403 (b) have a nice advantage over their friends with a 401 (k). According to the 15-year rule, employees with at least 15 years of service can add an extra

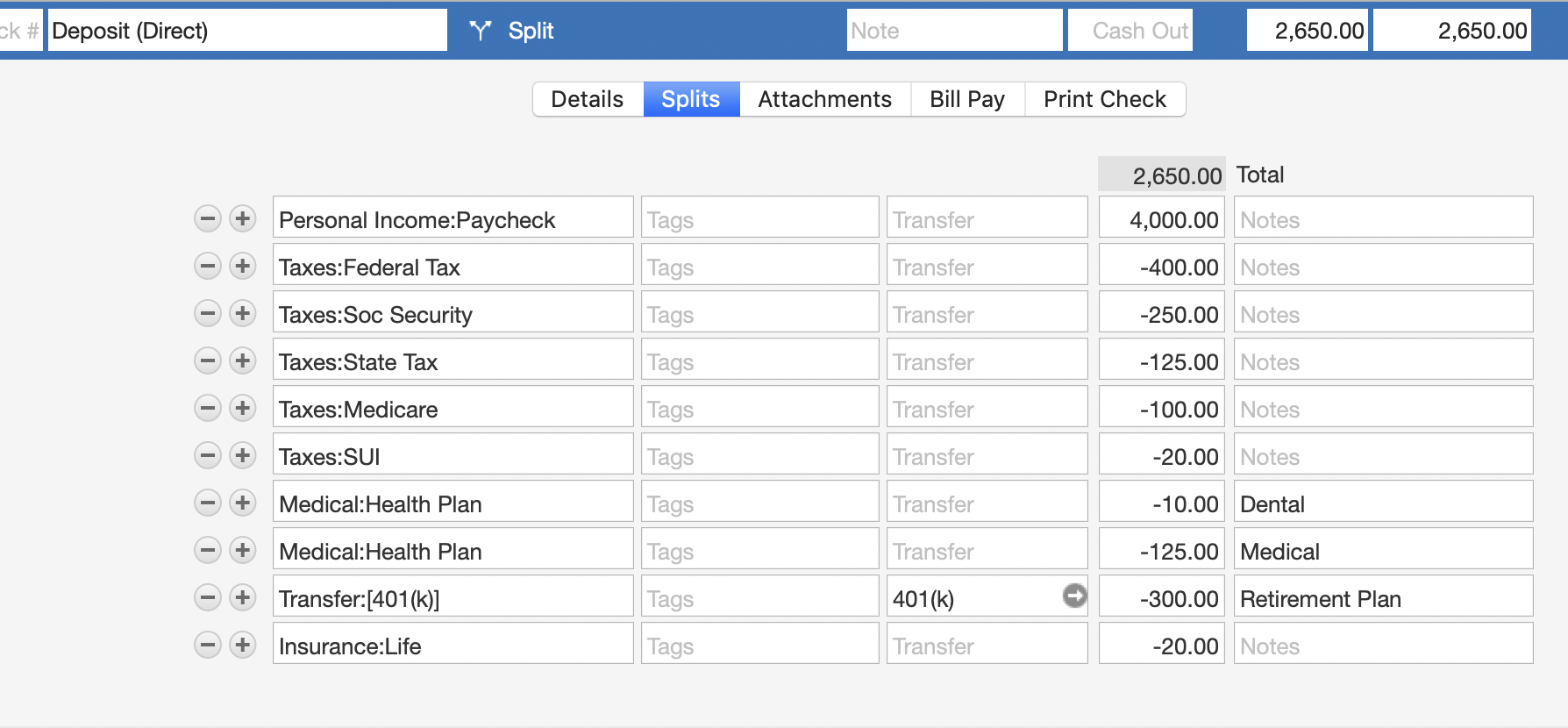

Source Image: community.quicken.com

Download Image

Feb 1, 2022Note that there’s a contribution limit for a 403 (b) and it fluctuates every year. According to the IRS, for 2022, the maximum combined contribution from the employer and employee is either

Source Image: optics-trade.eu

Download Image

Remittance Schedules: How to Know and Meet Your Deadlines – DMLO CPAs Feb 5, 2024You may contribute up to $22,500 yearly to a 403 (b) in 2023, or $23,000 in 2024. The contribution limits rise to $30,000 (2023) and $30,500 (2024) if you’re 50 or older. These limits are the same

Source Image: cwillisco.com

Download Image

How Much Should I Put In My 403b Per Paycheck

Feb 5, 2024You may contribute up to $22,500 yearly to a 403 (b) in 2023, or $23,000 in 2024. The contribution limits rise to $30,000 (2023) and $30,500 (2024) if you’re 50 or older. These limits are the same May 23, 20222009. $16,500. $5,500. $22,000. $49,000. IR-2008-118. The elective salary deferral limit increased from $19,500 to $20,500 for 2022. The catch-up limit for employees over age 50 remains unchanged at $6,500, which means the total maximum contribution for employees at least 50 years old has increased to $27,000.

The New Pinterest Algorithm Changes for 2021 — C. Willis & Co.

Jul 7, 2022How Much Should You Contribute to Your 403b Each Month? Most experts suggest saving 10-15% of your gross income annually toward retirement. For the average worker, this often translates to 5-10% of your paycheck contributed to a 403b account each month. So for example on a $60,000/year salary: Need Cash? Hardship Withdrawals From Your Retirement Plan Just Got Easier

Source Image: forbes.com

Download Image

403b Calculator: Calculate Your Retirement Savings (2024) Jul 7, 2022How Much Should You Contribute to Your 403b Each Month? Most experts suggest saving 10-15% of your gross income annually toward retirement. For the average worker, this often translates to 5-10% of your paycheck contributed to a 403b account each month. So for example on a $60,000/year salary:

Source Image: annuityexpertadvice.com

Download Image

How Much Money Do I Really Need to Retire? – Quick and Dirty Tips Jan 18, 2024The main difference between the 402b and other retirement plans is that if you have 15 years of service and your company is considered a “qualified organization”, you may be eligible to contribute an extra $3,000 to a 403(b). Therefore, 403b max contribution potentially increases to $22,500 or $29,000 per annum if you’re 50 or older.. Another difference is that 403(b) plans can only offer

Source Image: quickanddirtytips.com

Download Image

Remittance Schedules: How to Know and Meet Your Deadlines – DMLO CPAs Feb 1, 2022Note that there’s a contribution limit for a 403 (b) and it fluctuates every year. According to the IRS, for 2022, the maximum combined contribution from the employer and employee is either

Source Image: dmlo.com

Download Image

How Much Money Should You Have Saved For Your Age | 2024 Using the 403 (b) Savings Calculator. The calculator will not only take into account your current salary, but also anticipated salary increases and the higher contributions you can expect as a result. Most of the entries in the calculator are self-explanatory, but the following may be helpful. Annual salary : Enter your total pretax salary

Source Image: retirementliving.com

Download Image

This Timeline Shows You Exactly How to Save for Retirement | Reader’s Digest Feb 5, 2024You may contribute up to $22,500 yearly to a 403 (b) in 2023, or $23,000 in 2024. The contribution limits rise to $30,000 (2023) and $30,500 (2024) if you’re 50 or older. These limits are the same

Source Image: rd.com

Download Image

Christie’s L Chagall Et La Musique: 50 Works From The Artist’s Estate – Connoisseur Magazine May 23, 20222009. $16,500. $5,500. $22,000. $49,000. IR-2008-118. The elective salary deferral limit increased from $19,500 to $20,500 for 2022. The catch-up limit for employees over age 50 remains unchanged at $6,500, which means the total maximum contribution for employees at least 50 years old has increased to $27,000.

Source Image: connoisseurmagazine.co.uk

Download Image

403b Calculator: Calculate Your Retirement Savings (2024)

Christie’s L Chagall Et La Musique: 50 Works From The Artist’s Estate – Connoisseur Magazine Jan 12, 2024For 2024, the total contribution limit for a 403 (b) is $23,000. But if you’re age 50 or older and need to catch up, you can put up to $30,500 into your account. 1. And folks with a 403 (b) have a nice advantage over their friends with a 401 (k). According to the 15-year rule, employees with at least 15 years of service can add an extra

Remittance Schedules: How to Know and Meet Your Deadlines – DMLO CPAs This Timeline Shows You Exactly How to Save for Retirement | Reader’s Digest Using the 403 (b) Savings Calculator. The calculator will not only take into account your current salary, but also anticipated salary increases and the higher contributions you can expect as a result. Most of the entries in the calculator are self-explanatory, but the following may be helpful. Annual salary : Enter your total pretax salary